Let’s Get You Pre-ApprovedStart Your Home Search with a Mortgage Prequalification

efore you begin touring homes, it’s important to know what you can afford. At Trust Home Loans, we make it easy to get pre-qualified so you can start your homeownership journey with confidence. Simply complete our secure mortgage prequalification form online. With a prequalification letter in hand, you’ll know how much you may be approved to borrow — even before seeing your first home. In fact, many real estate agents require buyers to be pre-qualified before scheduling showings. A prequalification helps you focus your search, saves time, and strengthens your position when making an offer. It also makes the full mortgage application process much smoother down the line. Understand Your Credit Before You Apply Lenders use your credit score to evaluate your reliability as a borrower. This score is based on factors like your payment history, current debt, and income. The better your score, the better your chances of qualifying for a favorable mortgage rate. You can check your credit and score for free at trusted sites like freecreditreport.com or creditkarma.com. If your credit score is below 640, take time to review your report for any errors. Staying current on payments and paying down debt can help raise your score and improve your chances of approval.

Fixed-Rate vs. Adjustable-Rate Mortgages: Which Is Right for You?

When you’re ready to buy a home, one of the most important decisions you’ll need to make is choosing the right type of mortgage. For most homebuyers, the two primary options are Fixed-Rate Mortgages (FRMs) and Adjustable-Rate Mortgages (ARMs). Both offer distinct advantages and disadvantages depending on your personal financial situation, the current interest rate environment, and your long-term plans for the home. In this article, we’ll break down the key differences between these two types of mortgages, helping you make an informed decision that best fits your needs. By the end, you’ll have a clearer understanding of the factors that should influence your decision and be able to confidently select the right mortgage for your situation. What Is a Fixed-Rate Mortgage? A Fixed-Rate Mortgage (FRM) is the most traditional and commonly used mortgage type. As the name suggests, the interest rate on a fixed-rate mortgage remains constant throughout the life of the loan, meaning that your monthly payments will stay the same for the duration of the term. Key Features of a Fixed-Rate Mortgage: Advantages of a Fixed-Rate Mortgage: Disadvantages of a Fixed-Rate Mortgage: What Is an Adjustable-Rate Mortgage? An Adjustable-Rate Mortgage (ARM) differs significantly from a fixed-rate mortgage. With an ARM, the interest rate is initially lower than a fixed-rate mortgage but changes over time based on market conditions. The rate is typically fixed for a period at the beginning of the loan, after which it can adjust periodically (annually, every three years, etc.). Key Features of an Adjustable-Rate Mortgage: Advantages of an Adjustable-Rate Mortgage: Disadvantages of an Adjustable-Rate Mortgage: Which One Is Right for You? Choosing between a Fixed-Rate Mortgage and an Adjustable-Rate Mortgage depends on several factors. Here are some considerations to help you decide: 1. Your Plans for the Home 2. Your Tolerance for Risk 3. Current Interest Rate Environment 4. Your Financial Situation

The Hidden Costs of Homeownership: What to Expect Beyond Your Mortgage

Homeownership is a major milestone in life. It represents financial stability, independence, and the fulfillment of a long-held dream. Many people anticipate the joy of having their own space, the ability to customize it to their tastes, and the potential long-term financial benefits of building equity. However, owning a home isn’t just about making a mortgage payment and sitting back to watch the value of your investment rise. The reality is that homeownership often comes with unexpected financial burdens that can catch even the most prepared buyers off guard. In this article, we’ll explore the hidden costs of homeownership that go beyond the initial mortgage payment. Understanding these costs can help you budget more effectively and make informed decisions when buying your home. 1. Property Taxes: An Ongoing Obligation One of the most significant ongoing costs of homeownership is property taxes. These taxes are assessed by local governments based on the value of your property and can vary widely depending on your location. In some areas, property taxes can account for a significant portion of your overall housing expenses. What You Need to Know: Homeowners must factor in property taxes when determining the overall cost of owning a home, as these costs can rise over time, sometimes without warning. 2. Homeowners Insurance: Protecting Your Investment Another essential yet often overlooked cost is homeowners insurance. Lenders typically require insurance to protect their investment in case of damage to the property. However, even without a mortgage, it’s highly recommended to maintain homeowners insurance to safeguard against unexpected events like fires, natural disasters, theft, or vandalism. What You Need to Know: While homeowners insurance can feel like an unnecessary expense, it’s critical to have the right coverage to avoid significant financial strain in the event of an accident or disaster. 3. Maintenance and Repairs: The Never-Ending Costs Unlike renting, where your landlord is generally responsible for repairs, as a homeowner, you bear the full responsibility for maintaining and repairing your property. Over time, these costs can add up significantly. What You Need to Know: Homeownership can bring significant pride of ownership, but it also means that you will be financially responsible for every repair and replacement. A good rule of thumb is to budget at least 1% of your home’s value annually for maintenance and repairs. 4. Homeowners Association (HOA) Fees: A Hidden Cost for Some If you live in a community governed by a homeowners association (HOA), you’ll be required to pay HOA fees. These fees can be monthly, quarterly, or annual and are used to maintain shared spaces and enforce community rules. While they might seem like a small added expense, they can add up over time. What You Need to Know: If you’re buying a home in an HOA-governed community, it’s essential to consider both the monthly fee and the potential for special assessments when calculating your overall cost of ownership. 5. Utilities: The Hidden Cost of Comfort When renting, you may have had certain utilities included in your rent, but as a homeowner, you’ll be responsible for covering all utility costs. These costs can fluctuate based on the size of your home, the efficiency of your appliances, and the weather. What You Need to Know: As a homeowner, it’s crucial to budget for utility bills and be prepared for fluctuations in usage, especially during extreme weather months. 6. Renovations and Upgrades: Making Your Home Truly Yours Many homeowners dream of making improvements to their property, whether it’s remodeling the kitchen, adding a deck, or finishing the basement. While these upgrades can increase your home’s value and make it more enjoyable, they come with a significant cost. What You Need to Know: Before starting any renovation, it’s wise to carefully plan the budget and timeline to avoid surprises. 7. Moving Costs: The Expense of Transition Moving into a new home can also come with substantial costs that often aren’t considered until the last minute. Whether you’re hiring movers or renting a truck, these costs can add up quickly. What You Need to Know: Conclusion: Be Prepared for the Full Financial Picture While purchasing a home is an exciting and rewarding experience, it’s important to consider all the hidden costs that come with it. From property taxes to unexpected repairs and renovations, homeownership can be more expensive than many buyers initially anticipate. By budgeting for these additional costs and setting aside an emergency fund for unexpected expenses, you’ll be better prepared to handle the full financial responsibility that comes with owning a home. Taking the time to understand and plan for these hidden costs can make homeownership a far more manageable and enjoyable experience in the long run.

Understanding Mortgage Options, Rates, and How to Apply

Purchasing a home is one of the most significant financial decisions many people make in their lifetime. However, the process of securing a mortgage can be overwhelming, with various options, fluctuating interest rates, and an often complex application process. Understanding mortgage options, rates, and how to apply for one can help simplify this journey and put you in a stronger position to make informed decisions. In this article, we’ll explore the different types of mortgages available, how mortgage rates work, and provide a detailed guide on how to apply for a mortgage. Whether you’re a first-time homebuyer or looking to refinance, this comprehensive guide will give you the knowledge you need to navigate the mortgage process with confidence. What is a Mortgage? A mortgage is a loan used to purchase a home or other real estate. The home itself serves as collateral for the loan, meaning if the borrower fails to repay, the lender can take possession of the property through foreclosure. Mortgages typically come with specific repayment terms and interest rates, which are influenced by a variety of factors, such as the loan type, market conditions, and your personal financial situation. Key Mortgage Terms to Know: Before diving into the specifics of mortgage options, it’s essential to understand a few key terms commonly used in the mortgage industry: Different Types of Mortgages There is no “one-size-fits-all” mortgage. Understanding the different mortgage options available can help you select the right one based on your financial goals and circumstances. The most common types of mortgages are fixed-rate, adjustable-rate, and government-backed loans. 1. Fixed-Rate Mortgages A fixed-rate mortgage offers the stability of consistent monthly payments over the life of the loan. The interest rate is locked in at the time of the loan’s origination, meaning your payment amount won’t change, even if market rates fluctuate. Fixed-rate mortgages are typically available in 15-year, 20-year, and 30-year terms. Pros: Cons: 2. Adjustable-Rate Mortgages (ARMs) An adjustable-rate mortgage features an interest rate that fluctuates based on market conditions. Typically, ARMs start with a lower interest rate than fixed-rate mortgages, but that rate can change after an initial fixed period, usually 3, 5, 7, or 10 years. After the initial period, the interest rate may adjust annually or periodically based on an index such as the LIBOR (London Interbank Offered Rate) or the SOFR (Secured Overnight Financing Rate). Pros: Cons: 3. Government-Backed Mortgages Government-backed loans are designed to help homebuyers who may not qualify for conventional loans due to factors such as credit score or down payment size. These loans are insured by the federal government and are typically available through programs like FHA, VA, or USDA loans. Pros: Cons: Mortgage Rates and How They Work Mortgage rates are the interest rates that lenders charge for home loans. These rates can vary based on various factors, such as market conditions, your credit score, and the type of loan you’re applying for. Understanding mortgage rates is critical because even a small difference in rates can significantly impact your monthly payment and the total cost of the loan. Factors Influencing Mortgage Rates: Fixed vs. Adjustable-Rate Mortgage Rates With fixed-rate mortgages, your interest rate stays the same throughout the term of the loan. However, with an adjustable-rate mortgage, your interest rate can change periodically, usually after an initial fixed-rate period. It’s essential to be mindful of the potential for rate increases with ARMs, as they can cause your monthly payments to rise significantly over time. How to Lock in a Rate Once you’ve found a mortgage lender, you may have the option to “lock in” an interest rate for a specified period (usually 30 to 60 days). Locking in a rate guarantees that your interest rate won’t change during the lock period, even if market rates rise. This can provide peace of mind while you complete the home-buying process. How to Apply for a Mortgage The mortgage application process may seem complicated, but breaking it down into steps can make it much more manageable. Here’s an overview of what you can expect when applying for a mortgage: 1. Check Your Credit Report Before applying for a mortgage, it’s essential to review your credit report. A higher credit score will increase your chances of being approved and help you secure a better interest rate. If your score is low, consider working to improve it before applying for a mortgage. 2. Determine Your Budget Next, assess how much home you can afford. Lenders typically look for a debt-to-income (DTI) ratio of 43% or lower, although some may accept higher ratios based on your financial profile. Use mortgage calculators to estimate monthly payments and determine a comfortable price range for your new home. 3. Get Pre-Approved Getting pre-approved for a mortgage involves submitting your financial details (such as income, employment, assets, and debts) to a lender. Pre-approval shows sellers that you are a serious buyer and can help you secure a better deal. 4. Submit Your Application Once you’ve selected a lender, you’ll need to submit a formal mortgage application, which will include more detailed financial information and documentation, such as pay stubs, tax returns, and bank statements. 5. Underwriting and Approval The lender will review your application, assess your financial situation, and determine whether to approve or deny the loan. This process may take several weeks, and the lender may ask for additional documents during this time. 6. Closing the Loan After approval, you’ll enter the closing stage, where you’ll sign the loan agreement, pay closing costs, and officially take ownership of the property. The closing process usually involves a title company, real estate agents, and attorneys to ensure everything is in order. Conclusion: Taking the Next Steps Toward Homeownership Securing a mortgage is an essential step in purchasing a home, but it’s crucial to understand the different types of loans available, how rates work, and how to apply. By doing your research and preparing thoroughly, you can ensure a smoother experience and avoid common pitfalls. Remember, it’s not just

Understanding Mortgages: The Comprehensive Guide to Home Loans

Buying a home is often the most significant financial decision most people will make in their lifetime. However, unless you are lucky enough to have substantial savings or inherit wealth, you’ll likely need to secure a mortgage. A mortgage is a loan used to purchase real estate, and it can be one of the most crucial financial instruments you’ll use. In this article, we will break down everything you need to know about mortgages—from understanding how they work to exploring the various types available, how to get approved, and the long-term impact of your mortgage decisions. What is a Mortgage? A mortgage is a type of loan specifically used for purchasing property. It allows buyers to purchase a home without needing to pay the full price upfront. Instead, the buyer agrees to pay the lender over time, usually with interest, until the loan is fully paid off. Mortgages are typically structured with fixed terms, such as 15, 20, or 30 years, and are secured against the property you are buying. If the borrower fails to meet the loan repayment requirements, the lender has the right to foreclose on the property, meaning they can sell the house to recover the amount owed. The primary components of a mortgage include: Types of Mortgages There are several types of mortgage loans, each with unique characteristics and benefits. Let’s explore the most common types: 1. Fixed-Rate Mortgages A fixed-rate mortgage is the most straightforward and popular type. With a fixed-rate mortgage, the interest rate remains the same for the entire term of the loan. This means your monthly payments will be consistent and predictable, making it easier to budget over time. 2. Adjustable-Rate Mortgages (ARMs) An adjustable-rate mortgage (ARM) has an interest rate that changes periodically based on the performance of a specific benchmark or index. In the early years of the mortgage, the rate is typically lower than that of a fixed-rate loan, but after a specified period, it can adjust upwards or downwards. 3. FHA Loans Federal Housing Administration (FHA) loans are a type of government-backed mortgage designed to help first-time homebuyers and those with lower credit scores secure financing. These loans generally have lower down payment requirements, making them an attractive option for people with limited savings. 4. VA Loans Veterans Affairs (VA) loans are available to veterans, active-duty military personnel, and certain members of the National Guard and Reserves. These loans are backed by the U.S. Department of Veterans Affairs and offer significant benefits, including no down payment requirement and no private mortgage insurance (PMI). 5. Conventional Loans A conventional mortgage is any type of mortgage that is not insured or guaranteed by the government. These loans typically have stricter qualification criteria but offer the flexibility to choose loan terms, interest rates, and other features. How to Apply for a Mortgage Securing a mortgage involves a few key steps that can vary slightly depending on the type of loan you’re applying for. Here’s an overview of the mortgage application process: 1. Check Your Credit Score Your credit score plays a significant role in determining whether you’ll be approved for a mortgage and what interest rate you’ll receive. Lenders typically look for a score of 620 or higher for conventional loans, but government-backed loans may have more lenient requirements. 2. Evaluate Your Financial Situation Before applying for a mortgage, assess your current financial health. Consider your income, debt, and expenses. It’s a good idea to calculate your debt-to-income (DTI) ratio, which helps lenders evaluate your ability to repay the loan. 3. Save for a Down Payment The down payment is typically a percentage of the home’s purchase price, and it can range from as low as 3% for FHA loans to 20% for conventional loans. Saving for a down payment can take time, so plan ahead. Keep in mind that a larger down payment often results in better loan terms. 4. Get Pre-approved Once you have a good understanding of your finances, it’s time to get pre-approved for a mortgage. Pre-approval is a process where the lender evaluates your financial situation and determines how much they are willing to lend you. Getting pre-approved shows sellers that you are a serious buyer and can help speed up the home-buying process. 5. Choose the Right Lender and Loan Type With many lenders to choose from, it’s important to shop around for the best mortgage terms. Consider factors like interest rates, loan fees, and customer service. Additionally, explore different loan types to see which fits your needs. 6. Submit Your Application Once you’ve selected a lender and loan, you’ll need to complete a formal mortgage application. This application will require you to provide detailed information about your income, employment, debts, and assets. You’ll also need to submit supporting documentation, such as tax returns, pay stubs, and bank statements. 7. Underwriting and Approval After you’ve submitted your application, the lender will begin underwriting. This process involves verifying your financial information, conducting a home appraisal, and assessing your creditworthiness. Once the underwriting process is complete, you’ll either receive approval or be asked to provide additional information. 8. Closing The final step in the mortgage process is closing, where all the paperwork is signed, and you officially become the owner of the home. At closing, you’ll pay closing costs, which can include fees for appraisals, inspections, title insurance, and loan origination. Mortgage Payments and Interest Rates Your monthly mortgage payment will typically consist of four components: Understanding Interest Rates The interest rate on your mortgage has a significant impact on how much you will pay over the life of the loan. The rate may be fixed or adjustable, as discussed earlier, and can be influenced by several factors, including: Refinancing Your Mortgage Refinancing involves replacing your current mortgage with a new one, typically to secure a lower interest rate, change the loan term, or tap into home equity. Refinancing can be an effective way to lower your monthly payments or save money on interest, but it’s

Mortgage Basics for First-Time Buyers: A Comprehensive Guide

Purchasing your first home is a significant milestone, but navigating the world of mortgages can be overwhelming. As a first-time buyer, understanding the mortgage process is crucial to making informed decisions. This guide will take you through the essentials of mortgages, explaining key terms, the application process, and strategies to secure the best deal for your first home purchase. 1. What is a Mortgage? A mortgage is a loan that a borrower takes out to purchase a home or real estate. It is typically secured by the property itself, meaning the lender can take ownership of the property if the borrower fails to repay the loan. Mortgages are offered by banks, credit unions, and online lenders, and they come with specific terms, including the loan amount, interest rate, and repayment period. 2. How Do Mortgages Work? When you take out a mortgage, you’re agreeing to repay the loan, plus interest, over a period of time—usually 15 or 30 years. The monthly payment you make typically consists of: The exact breakdown of these components depends on the type of mortgage and the terms you agree upon with the lender. 3. Types of Mortgages There are several types of mortgages available to first-time homebuyers, each with its benefits and drawbacks. Understanding these options will help you choose the one that best suits your needs. 4. How Much Can You Afford? Before applying for a mortgage, it’s crucial to understand how much house you can afford. Several factors affect your borrowing capacity, including: 5. The Mortgage Application Process The process of applying for a mortgage may seem daunting, but breaking it down into steps can make it more manageable. Here’s what to expect: Step 1: Prequalification Step 2: Preapproval Step 3: Loan Application Step 4: Closing 6. Down Payments and PMI One of the biggest hurdles for first-time homebuyers is coming up with the down payment. While most conventional loans require at least 20% down, there are options for those who can’t afford such a large upfront payment: If you put down less than 20%, you may be required to pay Private Mortgage Insurance (PMI). PMI protects the lender in case you default on the loan. Once you’ve built enough equity in your home (usually 20%), you can request to have PMI removed. 7. Closing Costs and Other Fees In addition to the down payment, first-time buyers should be prepared for closing costs, which can add up to 2-5% of the loan amount. Common closing costs include: Understanding these costs upfront will help you budget and avoid surprises at closing. 8. Tips for First-Time Buyers Securing a mortgage as a first-time buyer is an exciting yet challenging process. By understanding the basics, including different loan options, the application process, and the costs involved, you can confidently navigate the homebuying journey. Start early, do your research, and work with trusted professionals to ensure you’re making the best decisions for your financial future.

How to Get the Best Mortgage Rates: A Step-by-Step Guide

Securing a favorable mortgage rate is crucial when purchasing a home, as even a slight difference in rates can significantly impact your monthly payments and the total interest paid over the life of the loan. This comprehensive guide outlines effective strategies to help you obtain the best mortgage rates available. 1. Understand the Factors Influencing Mortgage Rates Mortgage rates are influenced by various factors, including: 2. Improve Your Credit Score A higher credit score can qualify you for lower mortgage rates. To enhance your credit score: 3. Save for a Larger Down Payment A substantial down payment reduces the loan amount and can lead to better rates. Aim for at least a 20% down payment to avoid private mortgage insurance (PMI), which adds to your monthly costs. 4. Maintain a Low Debt-to-Income Ratio Lenders assess your DTI to determine your ability to manage monthly payments. To improve your DTI: 5. Shop Around and Compare Lenders Different lenders offer varying rates and terms. To find the best deal: 6. Consider Paying Discount Points Discount points are upfront fees paid to reduce the interest rate on your mortgage. One point equals 1% of the loan amount and typically lowers the rate by 0.25%. This strategy can be beneficial if you plan to stay in the home long-term, as it reduces your monthly payments. 7. Lock in Your Rate Mortgage rates can fluctuate between the time of application and closing. To protect against rising rates: 8. Choose the Right Loan Type and Term Selecting the appropriate loan type and term can impact your rate: 9. Maintain Stable Employment and Financials Lenders prefer borrowers with consistent employment and financial stability: 10. Stay Informed About Market Conditions Economic factors can affect mortgage rates: Securing the best mortgage rate requires careful planning, informed decisions, and proactive measures. By understanding the factors that influence rates and taking steps to improve your financial profile, you can position yourself to obtain favorable mortgage terms. Remember, the effort invested in this process

Common Mortgage Mistakes to Avoid: A Comprehensive Guide

Embarking on the journey to homeownership is both exciting and daunting. One of the most significant financial commitments you’ll make is securing a mortgage. However, the path to obtaining a mortgage is fraught with potential pitfalls. Understanding and avoiding common mistakes can save you thousands of dollars and ensure a smoother home-buying experience. 1. Neglecting to Check Your Credit Score Your credit score is a critical factor in determining the interest rate and terms of your mortgage. A higher score can lead to better rates, potentially saving you thousands over the life of the loan. Before applying for a mortgage, obtain a copy of your credit report and address any discrepancies or issues. Rest Less+6The Lifestyle Daily+6CBS News+6 2. Failing to Get Preapproved Many homebuyers skip the preapproval process, thinking it’s unnecessary. However, obtaining a preapproval letter from a lender shows sellers you’re a serious buyer and can afford the home. It also helps you understand how much you can borrow, guiding your home search. Experian Credit Report 3. Overlooking Additional Costs Beyond the down payment, homebuyers often overlook other expenses such as closing costs, property taxes, homeowners insurance, and maintenance. These costs can add up quickly and impact your budget. It’s essential to factor in these expenses when determining how much home you can afford. Clever Mortgage 4. Not Shopping Around for the Best Mortgage Rate Accepting the first mortgage offer you receive can be costly. Rates and terms vary significantly among lenders. By comparing offers from multiple lenders, you can secure a better deal and save money over time. MarketWatch 5. Choosing the Wrong Type of Mortgage There are various mortgage products available, each with its advantages and disadvantages. Choosing the wrong type can lead to higher costs or financial strain. For instance, adjustable-rate mortgages may start with lower rates but can increase over time, leading to higher payments. It’s crucial to understand the terms and select a mortgage that aligns with your financial situation and long-term goals. Investopediaparanych.com 6. Underestimating the Importance of a Home Inspection Skipping a home inspection to save money can be a costly mistake. An inspection can uncover hidden issues with the property, such as structural problems or outdated systems, allowing you to negotiate repairs or adjust your offer accordingly. Experian Credit Report 7. Making Major Financial Changes During the Mortgage Process Lenders assess your financial stability before approving your mortgage. Making significant changes, such as changing jobs, taking on new debt, or making large purchases, can affect your approval. It’s advisable to maintain financial stability throughout the mortgage process. Rest Less+5New York Post+5Experian Credit Report+5 8. Ignoring the Loan-to-Value Ratio The loan-to-value (LTV) ratio is the amount of your mortgage compared to the appraised value of the property. A higher LTV ratio can result in higher interest rates and the need for private mortgage insurance (PMI). Understanding and managing your LTV ratio can lead to better loan terms. 9. Overextending Your Budget It’s tempting to purchase a more expensive home, but overextending your budget can lead to financial strain. Lenders may approve you for a larger loan, but it’s essential to consider your comfort level and future financial goals. Aim to keep your monthly mortgage payment within a manageable percentage of your income. CBS News 10. Neglecting to Review the Fine Print Mortgage agreements are complex documents filled with legal jargon. Failing to thoroughly review the terms and conditions can lead to unexpected costs or obligations. It’s advisable to consult with a financial advisor or attorney to ensure you understand the terms before signing.

Trends Shaping the 2025 Mortgage Market: A Professional Outlook

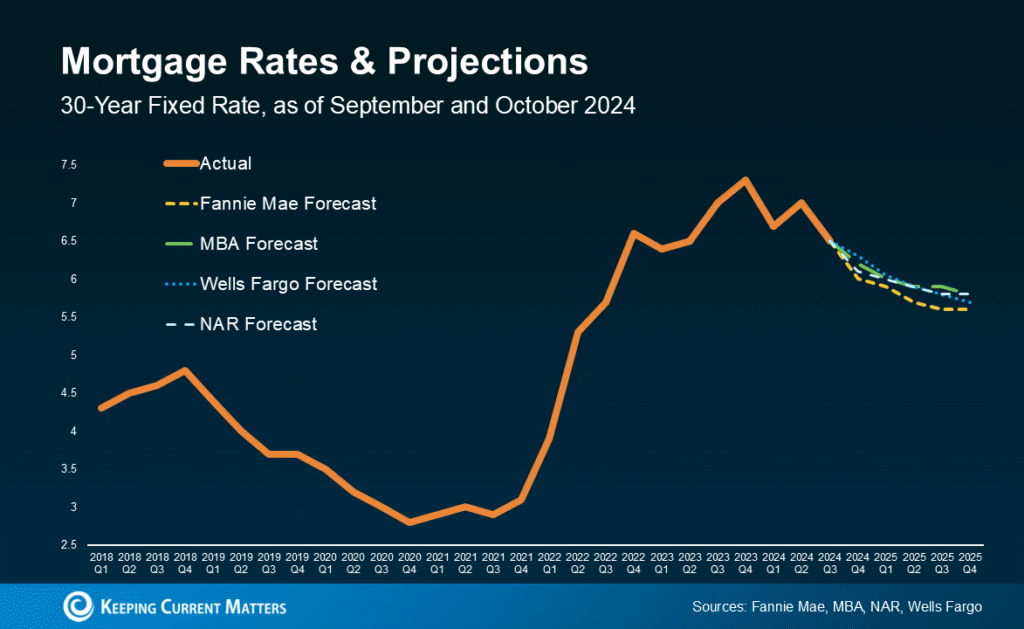

The mortgage industry in 2025 is experiencing significant transformations driven by technological advancements, evolving consumer behaviors, regulatory changes, and macroeconomic factors. This comprehensive analysis delves into the key trends influencing the mortgage landscape, providing professionals with insights to navigate the dynamic market effectively. 1. AI-Driven Mortgage Processes Artificial Intelligence (AI) is revolutionizing mortgage lending by enhancing efficiency and accuracy. AI applications include: Lenders adopting AI technologies are gaining a competitive edge by reducing processing times and operational costs . 2. Rising Interest Rates and Market Volatility Mortgage interest rates have seen upward trends due to: These factors are influencing borrower behavior, with potential declines in housing affordability and shifts in housing demand . 3. Regulatory Enhancements and Compliance Regulatory bodies are implementing stricter measures to ensure market stability and consumer protection: Mortgage professionals must stay abreast of these regulations to maintain compliance and mitigate risks. 4. Consumer Behavior Shifts The profile of mortgage borrowers is evolving: Lenders are adapting by offering tailored products and enhancing digital interfaces to meet consumer expectations. 5. Climate Change and Housing Market Impacts Climate change is influencing housing market dynamics: Lenders are incorporating environmental risk assessments into their underwriting processes to address these challenges . 6. Fintech Integration and Digital Transformation The integration of financial technology (fintech) is streamlining mortgage operations: These advancements are reducing operational costs and improving service delivery. 7. Market Outlook and Strategic Considerations Looking ahead, mortgage professionals should consider: By staying informed and agile, professionals can navigate the complexities of the 2025 mortgage market successfully.